The Only Guide for Estate Planning Attorney

The Only Guide for Estate Planning Attorney

Blog Article

Facts About Estate Planning Attorney Revealed

Table of ContentsNot known Details About Estate Planning Attorney Excitement About Estate Planning AttorneySome Known Questions About Estate Planning Attorney.10 Simple Techniques For Estate Planning AttorneyLittle Known Questions About Estate Planning Attorney.

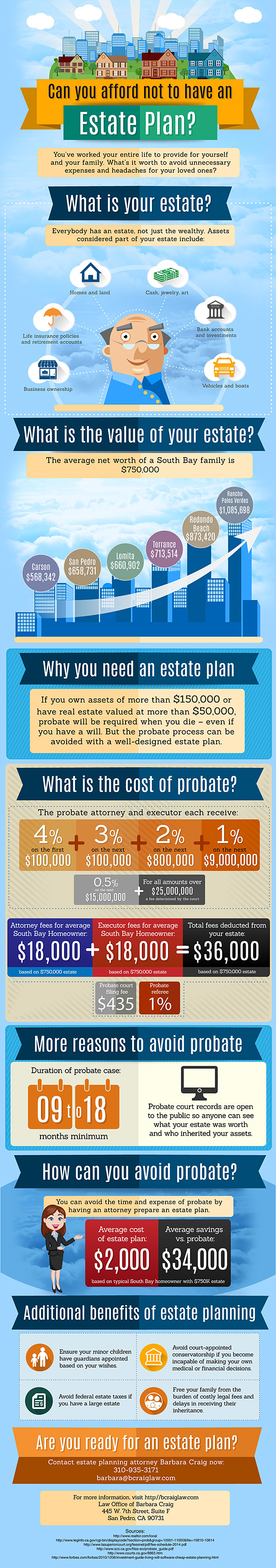

Dealing with end-of-life choices and safeguarding family members riches is a tough experience for all. In these tough times, estate planning attorneys assist people prepare for the distribution of their estate and establish a will, trust fund, and power of attorney. Estate Planning Attorney. These lawyers, also described as estate law lawyers or probate lawyers are accredited, knowledgeable experts with an in-depth understanding of the government and state legislations that put on just how estates are inventoried, valued, dispersed, and strained after fatality

The intent of estate planning is to properly prepare for the future while you're audio and capable. An appropriately prepared estate strategy sets out your last wishes exactly as you want them, in one of the most tax-advantageous way, to avoid any concerns, misconceptions, misconceptions, or disagreements after death. Estate preparation is a specialization in the lawful profession.

The 8-Second Trick For Estate Planning Attorney

These attorneys have a thorough understanding of the state and federal regulations associated with wills and depends on and the probate procedure. The duties and obligations of the estate attorney might consist of counseling customers and drafting lawful records for living wills, living depends on, estate plans, and inheritance tax. If required, an estate planning attorney may join lawsuits in court of probate on behalf of their clients.

, the employment of lawyers is expected to grow 9% in between 2020 and 2030. About 46,000 openings for attorneys are projected each year, on average, over the years. The course to ending up being an estate planning lawyer is similar to various other method locations.

Ideally, take into consideration possibilities to acquire real-world work experience with mentorships or teaching fellowships connected to estate planning. Doing so will give you the abilities and experience to make admittance right into law college and connect with others. The Law College Admissions Test, or LSAT, is an essential element of relating to law college.

Generally, the LSAT is view it now offered four times per year. It's important to plan for the LSAT. A lot of potential pupils start researching for the LSAT a year in advance, frequently with a research team or tutor. Many regulation pupils request regulation college throughout the autumn semester of the final year of their undergraduate studies.

The 10-Second Trick For Estate Planning Attorney

On standard, the yearly income for an estate attorney in the U.S. is $97,498. Estate preparing attorneys can function at large or mid-sized regulation companies or branch out on their very own with a solo method.

This code connects to the limitations and rules enforced on wills, counts on, and various other legal papers relevant to estate preparation. The Uniform Probate Code can vary by state, however these laws control different facets of estate planning and probates, such as the development of the count on or the legal legitimacy of wills.

Are you uncertain regarding what occupation to seek? It is a complicated inquiry, and there is no simple response. You can make some factors to consider to assist make the choice much easier. First, rest down and list things you are good at. What are your strengths? What do you take pleasure in doing? As soon as you have a listing, you can tighten down your choices.

It involves choosing exactly how your properties will certainly be dispersed and who will certainly handle your experiences if you can no more do so on your own. Estate preparation is an essential component of monetary preparation and should be made with the assistance of a qualified expert. There are several variables to take into consideration when estate preparation, including your age, health, financial scenario, and family members circumstance.

Getting The Estate Planning Attorney To Work

If you are young and have few ownerships, you might not require to do much estate planning. Health and wellness: It is an important element to take into consideration when estate preparation.

If you are married, you need to think about exactly how your possessions will certainly be dispersed between your partner and your successors. It intends to ensure that your properties are distributed the means you desire them to be after you die. It includes taking into consideration any kind of tax obligations that may require to Homepage be paid on your estate.

The smart Trick of Estate Planning Attorney That Nobody is Discussing

The attorney also assists the people and family members produce a will. The attorney also helps the people and families with their counts on.

Report this page